As the first half of 2025 concludes, the competition among large AI models has intensified. The latest data from OpenRouter reveals a significant shift: performance is no longer the sole metric—cost-effectiveness is now king. This article provides an in-depth analysis of how Google’s Gemini is leading the market, the surprising rise of DeepSeek, and the challenges facing OpenAI and Anthropic.

Time flies, and half of 2025 is already over. In the world of large text-generation models, these six months have been nothing short of tumultuous. We all know that the competition is no longer just about benchmark scores in a lab; it’s a real battleground of API services. Which models are developers actually using? Who is the true “king of service” accepted by the market?

Recently, based on the latest data from OpenRouter (a platform that aggregates multiple AI models), we’ve gotten a glimpse into the true state of the AI API market in the first half of 2025. This data is fascinating, showing how Google’s Gemini series, Anthropic’s Claude family, and rising stars like DeepSeek are positioning themselves in this fierce race.

The focus of this competition seems to have shifted—it’s no longer about who has the largest model parameters, but who can find the optimal balance between performance and price.

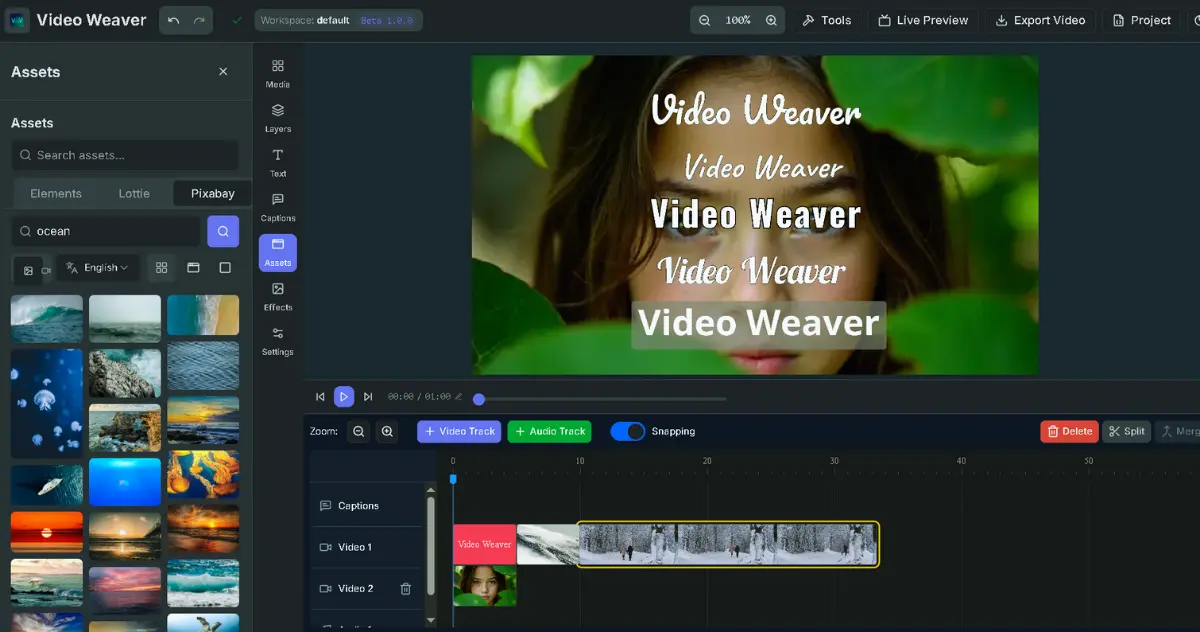

Lightning Speed, Affordable Price: Gemini Flash Securely at the Top

Honestly, seeing the top spot on the leaderboard wasn’t a huge surprise, but its lead is truly astonishing. According to OpenRouter’s data, Google’s Gemini 2.0 Flash is currently the most popular model.

Why does it reign supreme? The keywords are: fast and cheap.

Gemini 2.0 Flash was designed from the ground up for high-speed responses and high throughput. For applications that need to handle a large volume of real-time requests (like chatbots or instant translation), speed is crucial. More importantly, its price is just $0.40 per million output tokens. This powerful combination of high performance and low cost has quickly won over a vast number of developers.

Following closely is Anthropic’s Claude Sonnet 4, which continues to perform steadily. Meanwhile, another Google model, Gemini 2.5 Flash Preview (0520 version), ranks third, demonstrating strong future potential.

The Dark Horse That Can’t Be Ignored: The Surprising Rise of DeepSeek V3

The most eye-catching player on the leaderboard is undoubtedly DeepSeek V3 from China.

Looking at the list, the free and paid versions of DeepSeek V3 rank fourth and fifth, respectively. However, here’s an interesting detail: if you combine the token usage of these two versions, the total volume is nearly comparable to the second-place Claude Sonnet 4! This is a very strong signal.

Since its release, DeepSeek V3 has been praised within the developer community for its incredible “performance-to-price ratio.” It’s not only affordable but also performs exceptionally well in code generation and logical reasoning. Many developers have found that in certain scenarios, DeepSeek’s capabilities can even approach those of the more expensive Claude 3.5 Sonnet.

Its consistent presence in the Top 10 indicates very high user stickiness. For teams looking to control costs without sacrificing too much performance, DeepSeek is clearly a highly attractive option.

From Explosion to Stability: Market Demand is Diversifying

Observing the overall trend graph for the past six months, we can see a clear development trajectory.

In the first quarter of 2025, the entire AI API market experienced explosive growth. On the OpenRouter platform, total token usage quadrupled in just a few months. This shows that the market’s appetite for AI applications reached a peak.

Subsequently, however, the market entered a relatively stable plateau phase. Currently, the total weekly token consumption is steady at around 2 trillion. This doesn’t mean the market has cooled off; rather, it indicates that the application of large AI models has shifted from an initial “novelty craze” to stable, ongoing business demand.

Another noteworthy phenomenon is the “long-tail effect.” Besides the top-ranking star models, the usage of other non-leading models has also stabilized at 600 to 700 billion tokens. What does this reflect?

It shows that developer needs are diverse. Different application scenarios require different models. Some tasks need the most powerful reasoning capabilities (perhaps choosing GPT-4 or Claude Opus), while others prioritize speed and cost (choosing Gemini Flash or DeepSeek). A maturing market means that satisfying niche demands is becoming increasingly important.

The Giants’ Strategies: Google’s Precise Positioning vs. Claude’s Smooth Transition

In this API war, Google’s strategy appears particularly precise.

With the sharp sword of Gemini 2.0 Flash, they have firmly captured the largest share of the low-to-mid-end market through low prices and high efficiency. At the same time, the newly launched Gemini 2.5 Flash, an iterative version with stronger performance, has already rushed to third place while still in its preview stage. It’s foreseeable that once 2.5 Flash’s price is reduced in the future, it will likely completely take over the market position of 2.0 Flash.

In contrast, the high-end Gemini 2.5 Pro, despite replacing earlier experimental versions, has seen limited growth in usage. This also reflects that the current market demand for “ultimate performance” is far less than the demand for “good enough and cheap.”

Now let’s look at Anthropic. Their Claude series has completed a smooth generational transition. The older Claude 3.5 Sonnet and Claude 3.7 Sonnet have gradually faded from the charts, successfully replaced by Claude Sonnet 4.

Claude Sonnet 4’s market performance is very stable, maintaining its second-place position, which proves its performance reliability is recognized by users. However, it hasn’t achieved the explosive growth seen by Gemini Flash. This indicates that while Anthropic maintains the quality of its high-end models, it is under significant market pressure from lower-priced models like Gemini Flash and DeepSeek.

What Happened to OpenAI? The Roller Coaster Ride of GPT-4o-mini

When talking about AI models, how can we not mention OpenAI? But honestly, their performance on the OpenRouter charts in the first half of 2025 has been somewhat unpredictable.

The performance of GPT-4o-mini has been like a roller coaster. Yes, some may remember that in May, GPT-4o-mini had a brief moment of glory with a surge in usage, even leading at one point. This demonstrated OpenAI’s strong brand appeal and successful marketing.

However, looking at the data for the entire first half of the year, its usage has fluctuated wildly. In the latest data, it barely squeezed into the bottom of the Top 10 (tenth place), with token usage significantly reduced from its peak.

This unstable performance could mean a few things: perhaps OpenAI’s pricing strategy in the API market doesn’t fully align with developers’ long-term budgets, or maybe their current strategic focus has shifted, and they aren’t offering a multi-tiered, cost-effective range of API choices like Google. In any case, for a former absolute leader, this report card is clearly not ideal.

Future Outlook: It’s Not Just About Performance, It’s About Being “Worth It”

Looking back at the first half of 2025, the rules of the game in the AI API market have clearly changed. The era of purely pursuing model performance is over; we are now in a new phase of competing on a combination of performance and price.

Google has successfully captured the largest market share with its clear low-price strategy and the fast Flash series. DeepSeek, relying on the advantages of the open-source community and its excellent cost-effectiveness, has proven itself to be a rising force that cannot be ignored.

For Anthropic and OpenAI, the future challenge lies in how to adjust their pricing strategies or optimize their ecosystems to counter the impact of low-cost models while maintaining their leading performance.

Ultimately, AI API services will focus more on specific application scenarios and the construction of developer ecosystems. Whoever can provide the most “cost-effective” and “easy-to-use” tools will be the one to have the last laugh in this long-term battle.